Microsoft Dynamics GP–United Kingdom, Making Tax Digital (VAT) for business MTD / MTSfb

Update 23rd April 2019

April 2019 Hotfix for Dynamics GP - Making Tax Digital.

Microsoft have released a bug fix to the error:

You may incorrectly receive an error in VAT Daybook Obligation period dates do not match with the VAT Daybook Calendar.

This occurs when logged in as the user SA, this bug fix also incorporates the full original update from Feb 2019.

Full details here: Microsoft Dynamics GP April Hotfix 2019 - more changes for VAT!!

Update 13th March 2019

Microsoft have released further details of the support added into Dynamics GP for MTD.

Microsoft Dynamics GP: 'Making Tax Digital' functionality for UK VAT

Update: 30th Jan 2019

Microsoft have released the following information post about VAT and Dynamics GP due to the questions raised by people preparing for Making Tax Digital. Worth a read here, Microsoft Dynamics GP: Information about the VAT 100 Return

Update: 26th Nov 2018

https://m-hance.com/making-tax-digital-for-vat/

https://m-hance.com/making-tax-digital-for-vat/

Although I know of some ISVs creating solutions for MTD, the first of the ISV solutions for GP to go public, from what I can see is m-hance.

"Making Tax Digital for VAT" (MTDfV) - an offering from m-hance for Dynamics GP. See the details.

Keep an eye out for others ISVs publishing their solutions, over the months, as we lead up to mandatory deadline for electronic VAT submissions.

Update: 3rd Aug 2018

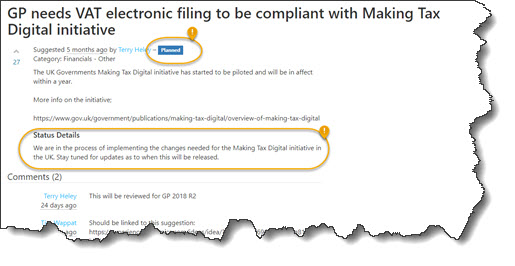

Steven MacDonald @SteMac_mhance kindly pointed out on twitter in July that this requirement was being reviewed for inclusion in Dynamics GP2018 R2.

the Ideas page has now been updated. "This will be reviewed for GP 2018 R2" https://t.co/5OuGwgIspD

— Steven MacDonald (@SteMac_mhance) July 19, 2018

Today, Ian in a post over on his blog, points out a status change on the MTD suggestion Microsoft Dynamics GP and Making Tax Digital

This certainly sounds promising from the MS Suggestion Site https://experience.dynamics.com/ideas/idea/?ideaid=366ea083-6029-e811-bbd3-0003ff68ba15

We are in the process of implementing the changes needed for the Making Tax Digital initiative in the UK. Stay tuned for updates as to when this will be released.

Original post:

Making Tax Digital is a Her Majesty's Revenue and Customs (HMRC) introducing a mandatory electronic filing of VAT (tax) returns by business by using an application that supports their application programming interface (API). VAT records must be maintained and submitted digitally after April 2019. HMRC are encouraging software developers to engage with them to create applications to interoperate with their APIs HMRC Blog - Digital Relationship Management – A new era in 3rd party software collaboration. Xero and other software companies have been working on the private Beta of the APIs for some time, but what about Microsoft?

HRMC - Overview of Making Tax Digital

Dynamics GP, SMB products and Making Tax Digital VAT submission MTD

Microsoft Dynamics products AX, NAV, 365 Finance & Operations will all enable customers to be compliant, the details of how is yet to become clear, perhaps bridging software?

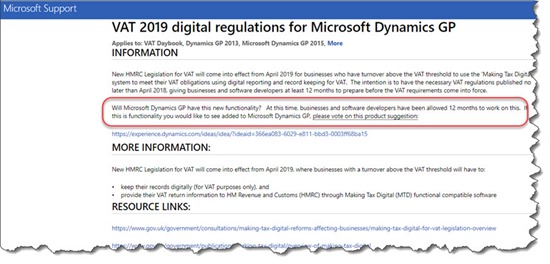

Did you know the Microsoft SMB ERP products also include Dynamics GP too? -Dynamics GP already allows VAT to be recorded electronically and even has the VAT daybook functionally. You would think it not too great a leap to create a little helper application that could pluck the records from the database and submit them via the HMRC web API. It is disappointing that in April 2018 all we have from Microsoft is this page for users of GP.

that points to the suggestion list for new features for GP…

Suggestion: GP needs VAT electronic filing to be compliant with Making Tax Digital initiative

So one may think from this that there are no plans in action at the moment for it to be supported, on the other hand you could take the view this is Microsoft acknowledging the requirement, perhaps Terry may well have had her ear bent by the UK Dynamics partners thus creating this page? Admittedly it is a year away and the MS developers can work quite quickly when they need to. Also to be fair this product suggestion site is the funnel through which new features/requirements should be captured, so perhaps it is in hand?

However it would be nice to know soon if UK customers need to find another 3rd party bridging software to the HMRC APIs soon so we can start answering our Finance Directors and Controllers questions about what the plan is for 2019 (and yes that question sparked this blog post).

Spreadsheets

What is amusing is that HMRC have announced that spreadsheets are acceptable when used with bridging software to the APIs – heaven knows what accountants would do without them!

“Businesses will be able to continue to use spreadsheets for record keeping, but they must ensure that their spreadsheet meets the necessary requirements of Making Tax Digital for Businesses. This is likely to involve combining the spreadsheet with software.”

Accounting web- Spreadsheets for Making Tax Digital – The universal language of accounting

I will update this post if there are further developments over the year.